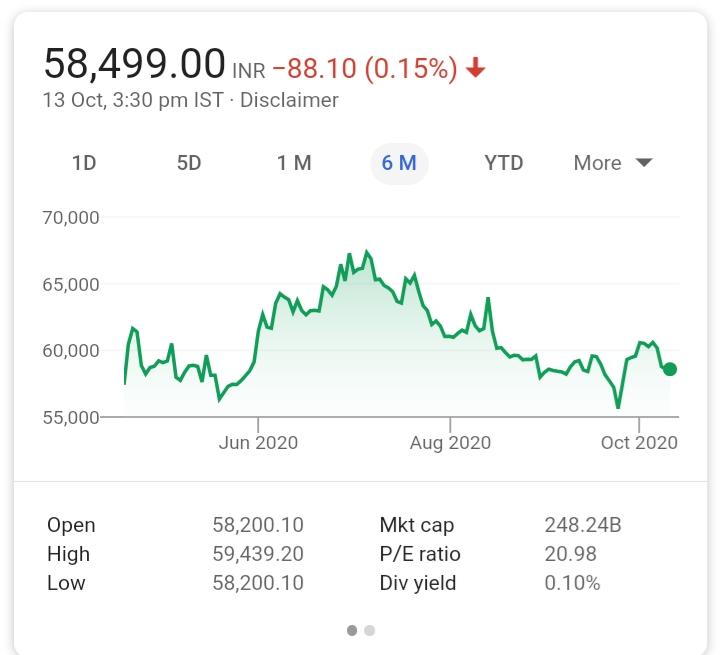

On 13th October 2020, MRF shares stand at a whopping 59,000 INR per share,no doubt in being the costliest share in India. And around April 2018, the stock hit its highest lifetime value of 81,423 and closed at around 79,000 in the bombay stock exchange.If you had bought these same shares five years ago you’d have earned around 47% returns.

WHAT IS THE REASON BEHIND THE SHARE BEING SO PRICEY?

The reason behing such a big value is the company not having it’s share split. Because as more outstanding shares increase,the lower is the price and vice versa. So an individual investor in MRF has bigger holdings though the market capitalisation is constant. Which, in turn makes the share less volatile in the market, which many retail investors can’t afford so they don’t get their hands on it. Thus, the voting rights are safe, while having the uniqueness and luxury of being India’s costliest share without any regulatory hindrances!

WHAT IS THE HISTORY AND CURRENT PROFILE OF THIS SHARE?

It was founded by K.M. Mammen Mappillai, and the share went public in April 1993 with just a facr value of 10rs per share. And within 27 years, it has given whopping returns to its patient investors, just like Warren Buffett’s Hathaway.

The current profit of this company for FY20 is rs 1395 crores, with a dividend yield of 0.159 percent per share, amounting to 94 rs for a stock price of 59,000.